Table of Content

When you’re comparing home loans, it can be important to consider the APR. Included in the APR will be the calculation of the appropriate fees to get the loan. Not all loan closing costs are included when calculating the APR.

USDA loans, otherwise known as the United States Department of Agriculture loans, are another government-backed financing option offered through private lenders. Although similar to VA loans, there are some subtle differences to note when deciding whether a USDA loan makes sense for your situation. You can check our rate table regularly for current information on various lenders. You can also visit lenders’ websites to see their VA interest rates today, and research the best VA mortgage lenders. The average 30-year VA refinance APR is 6.16%, according to Bankrate's latest survey of the nation's largest mortgage lenders.

Reasons to Avoid a Loan With a Balloon Payment

And remember, you don’t have to refinance with your current mortgage lender. A VA loan can only be used to fund the purchase of a home that will be your primary residence. The VA has an occupancy requirement mandating that you move in within 60 days after closing. You cannot use a VA loan to purchase land by itself, even if you intend to build a home later.

You can find all of the VA loan products we’ve reviewed so far at LendingTree. You cannot see rates without doing LendingTree's survey and soliciting offers. VA ARM loans cap the initial and subsequent caps to 1% yearly on hybrid ARMs that adjust in less than five years. Different lenders will be willing to work with different credit scores. Interest rates will be much higher for borrowers with lower credit scores, however.

Can I use a VA loan to build a house?

These loans are available up to 100 percent of the home’s current appraised value. To establish the current home value, a new appraisal is required. In short, you can refinance any home loan into a VA loan with more favorable terms — regardless of the type of loan it is. The VA IRRRL, by comparison, is a VA-to-VA loan program only. You cannot use the IRRRL program if your current loan is FHA or any other type. VA-approved lenders can check eligibility, often within minutes, via direct online requests to the Department of Veterans Affairs.

You are a current/former military member who has either served a minimum of 181 consecutive days during peacetime or a minimum of 90 consecutive days during wartime. Here are the steps to using a basic VA mortgage loan calculator. There are also qualifying exceptions for those discharged owing to a service-related disability, hardship, early out, and certain other causes. Whatever your type of service, you’ll need an honorable discharge to qualify. Be sure to shop around and find the best VA mortgage rate available to you. If you have the Certificate of Eligibility you used to get your original VA-backed home loan, take it to your lender to show the prior use of your entitlement.

About the VA funding fee

VA borrowers do not have to pay PMI, but they do have to pay a funding fee. However, the VA funding feetends to be much less expensive than PMI because you only pay it once, not year after year as with a conventional loan. If you lock in today’s 5/1 ARM interest rate of 5.46% on a $100,000 loan, your monthly payments will be $565. Lastly, remember that your interest rate is only one factor in choosing a VA home loan.

While getting your COE is the starting point of getting a VA home loan, it is not the only step. You must also satisfy the lender’s requirements and ensure that the property meets all the MPRs. There are three steps to prove your eligibility for the loan.

Best VA Mortgage Rates for December 2022

You can calculate the annualized interest by multiplying the current mortgage balance by the annualized interest. You can then convert the result into a percentage by multiplying it by 100. The annual interest rate is the cost of borrowing money to the borrower expressed as a percentage. You will need to give your lender information about your military service to get your COE. You can also acquire a COE online via a lender’s portal on VA.org.

Private lenders, such as mortgage companies and banks, set interest rates on VA loans. The Department of Veterans Affairs does not set the rate but backs a portion of each loan against default. VA mortgages can only be originated by lenders approved by the US Department of Veterans Affairs. In addition, some lenders specialize in conventional loans, whereas others specialize in VA loans. Several mortgage companies and banks are available that set interest rates on VA loans.

You’re more likely to receive competitive loan terms if you have a credit score of 740 or above and a debt-to-income ratio below 43 percent. The above mortgage loan information is provided to, or obtained by, Bankrate. Some lenders provide their mortgage loan terms to Bankrate for advertising purposes and Bankrate receives compensation from those advertisers (our "Advertisers"). Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria. In addition to assumptions above, current advertised rates for fixed rate purchase loans assume a 30-day lock period, no down payment and a $295,000 loan amount. FHA and conventional mortgage rates tend to be higher than VA loan rates.

You enjoy your benefit, but have the convenience and speed of working with your chosen lender. One of the remarkable benefits of VA loans is that they are available at highly competitive rates. While the VA-approved private lenders set these rates, the VA department makes sure they are available at lower interest rates.

To arrive at the APR, you will need to add the sale price of the home or the appraised value of it to the amount of the costs. Your VA home loan interest rate is what your loan costs over the lifetime of the mortgage. You will be offered an interest rate, which you can multiply by the amount of the loan multiplied by the percentage of the interest. The amount you get is the interest you would pay on that loan for the year. To build off of our previous example, if we had a $300,000 loan and $6,000 in closing costs, that would mean a total loan of $306,000.

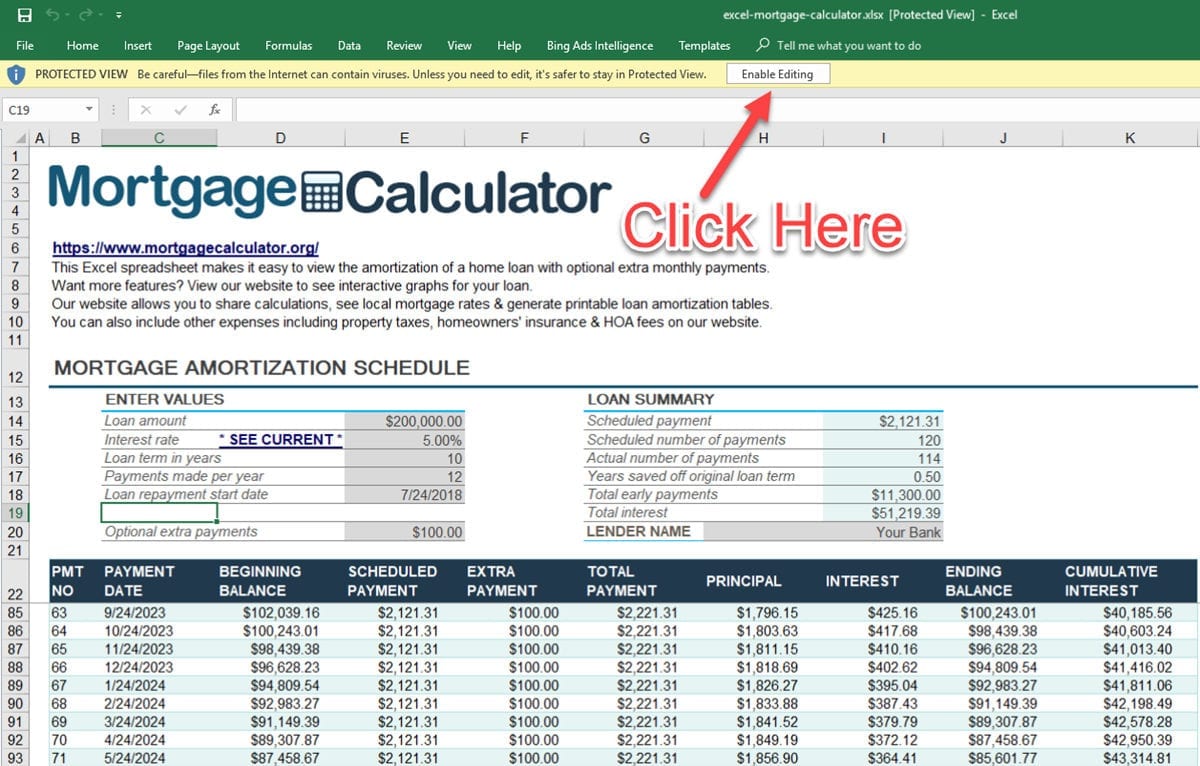

USDA loans do have income limitations, while VA loans are generally unrestricted in this aspect. If you’re looking to secure the best loan rate in 2020 without making a large down payment, it may be the right time to consider a VA loan. If you want to see how a VA loan can benefit you and your family, be sure to check out our helpful mortgage calculator. Additionally, a VA loan must be used on your primary residence and may carry additional fees if it’s not the first time you’ve used it.

Satisfying the Lender’s Requirements

On average, VA loans have the lowest rates of any major loan program. As of today, 30–year fixed VA loan interest rates start at 3.25% (3.431% APR), according to our lender network. For a conventional loan, that would be 3.625% (3.634% APR).

For instance, say a veteran got a non-VA loan for $200,000 at an interest rate of 6.5%. For example, the Department of Veterans Affairs allows up to 100% financing. So you can technically withdraw all your home equity using a VA cash-out loan. The cash back can be used to pay off other debt, pay for home improvements, invest in real estate, or for any other purpose. You can check the full list of eligibility requirements here. The acronym is short for Annual Percentage Rate, and this rate is indicative of the actual cost of your VA mortgage.

No comments:

Post a Comment